NO INTEREST IN INTEREST RATES?

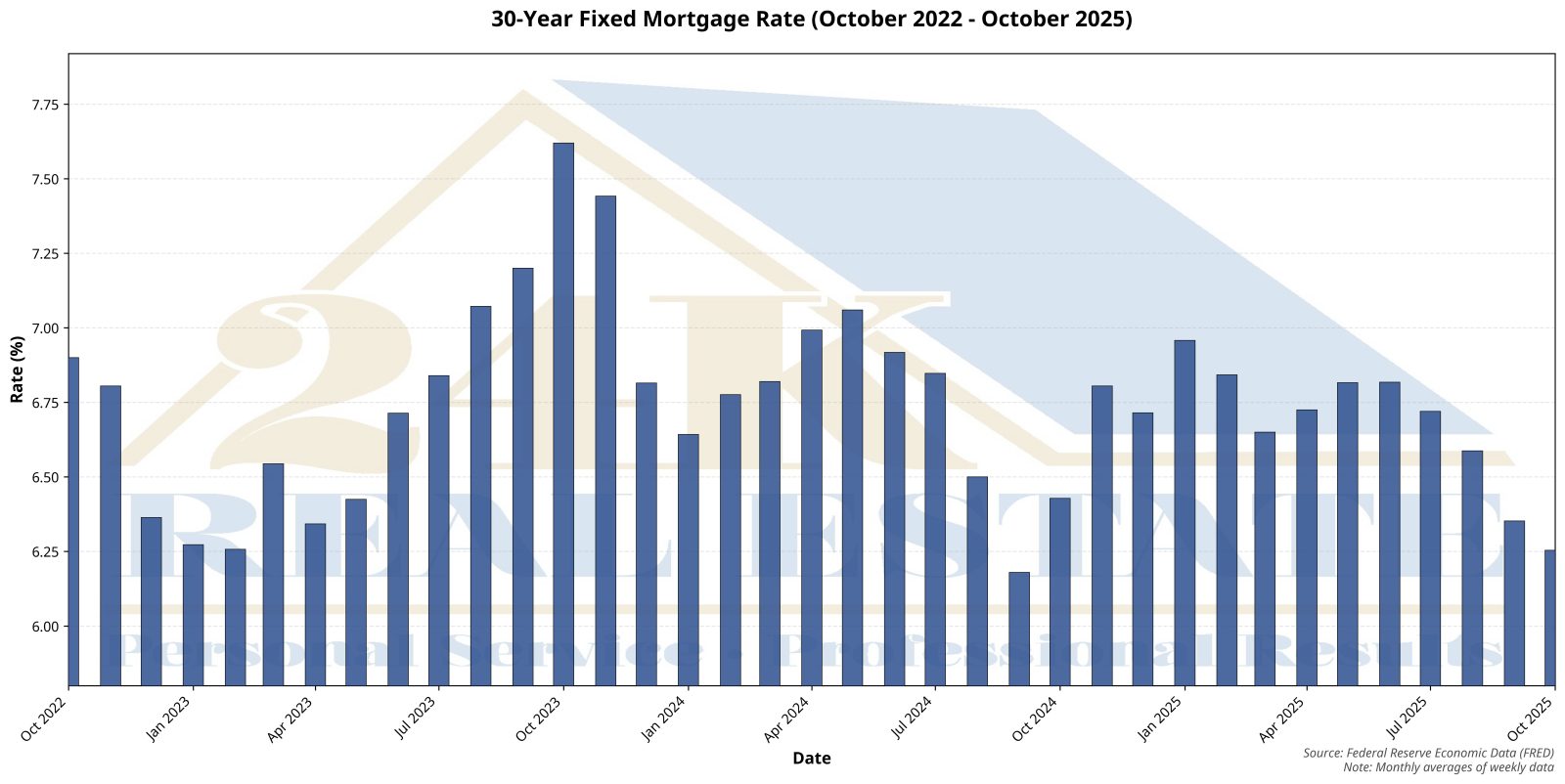

The real estate market has a way of humbling even the most seasoned professionals. Over the past three years, we’ve seen mortgage rates climb to highs not experienced in over two decades—peaking above 7% in the fall of 2023—only to gently retreat through late 2024 and into 2025. By October 2025, the average 30-year fixed rate had eased back to around 6.3%. In theory, that should have unlocked a flurry of buyer activity. After all, who doesn’t love a discount on borrowing?

And yet, the sales data tells a different story. Instead of a noticeable surge in closings, we’re watching a market that seems more interested in sipping coffee than sprinting to the closing table. Buyers, it appears, have not been stirred by this modest relief.

Why the collective shrug? Part of the answer lies in affordability. While rates have cooled, they haven’t cooled enough to bring monthly payments back within easy reach, especially with home prices still holding firm in many areas. For would-be sellers, the lock-in effect remains powerful—trading a 3% mortgage for a 6.3% one, even with softer rates, simply doesn’t pencil out. And for buyers, the psychological sting of rates that are “lower” but still historically high is hard to ignore.

So we sit in this curious limbo: rates are down, but momentum isn’t up. The market, it seems, has developed a selective hearing problem—politely nodding at the Fed’s efforts while refusing to leap into action.

As an experienced agent, I’d offer this takeaway: interest rates may set the tempo, but they don’t write the music. Inventory, affordability, and consumer confidence remain the real headliners. Until those elements strike a more harmonious chord, buyers and sellers alike may continue to dance around the floor without fully committing to the waltz.

copyright 24K Real Estate 2025