Real Estate Newsletter October 2013

As I write this real estate newsletter we are in the midst of a government shutdown. In my opinion while there is never a good time for something like this to happen, now is a particularly challenging time. The economy was already slowing heading into the fall and we are only 60 days away from the most important retail season of the year. Consumer confidence and discretionary spending could be shaken by this. That impact will only increase with time so the faster there is a good resolution and a cease to the shutdown the better. Typically there is a slowdown during the end of summer but usually in mid-September through October things improve to a steady flow. In the short term we will see fewer buyers and fewer houses come on the market which might actually benefit current sellers in the $450,000 and under market. There is already a shortage of inventory in that range, especially under $350,000 and the reduction of houses coming on the market will likely offset the drop in buyer traffic. However for higher priced homes I think the lower demand will favor the buyer in negotiations. An encouraging note to share is that in the first two weeks of the shutdown I have not seen a drop in the amount of homes going under contract in most areas. That indicates we are experiencing a pretty resilient recovery in the housing market and hopefully this shutdown will not last long enough to significantly stifle that. Potentially this could lead to a better spring selling season too as there will likely be pent up buyer demand from those deciding to hold off during this time of uncertainty as well as a continuation of limited inventory. If that is the case the pendulum will once again swing towards the seller and price appreciation.

Prior to the government shutdown inventory began leveling off and prices did as well. As a result buyers are once again getting better response from sellers in both price and terms. Sellers are still doing well in that they can sell in about half the time it took last year and often less than that. As I stated in the first paragraph, the outlook for sellers in certain price points might be a bit tempered due to the shutdown however I happen to believe there is still good opportunity in the sub $450K range.

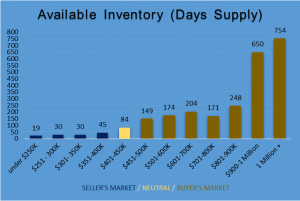

So how do you know how to approach the market if you are buying or selling? Well it helps to know whether you are selling or buying a home in a busy segment of the market so here is a summary of the market by price point. I have marked each segment as either a seller’s or buyers’ market. It is quite intriguing; but just in case it doesn’t have you on the edge of your seat here’s a cliff hanger – be sure to read all the way to the end where I share how to break any market trend whether you are a buyer or seller.

Key Points

$250,000 and under

You are sitting on a gold mine. There is only a 19 day supply of homes available.

$251,000 to $300,000

Still sitting pretty as there is barely a 30 day supply of homes available

$301,000 to $350,000

Starting to see a trend here? Once again barely a 30 day supply on the market

$351,000 to $400,000

Balanced market so it’s more neutral and will depend more on motivations of seller or buyer

$401,000 to $450,000

Typically more give and take on a seller’s part; still opportunity for sellers with good location and condition

$451,000 to $800,000

Typically a six month or more supply once you break $500K. Still good for sellers in the sub $500K range if the home shows well.

$801,000 to Million+

There is over a two year supply of homes in the million plus range.

Now onto the Cliffhanger!!!

How do you outperform the market if you are a seller in a buyer’s market or save money if you are a buyer in a seller’s market? Well you hire Dave Kupernik of course! And you don’t have to just take my word for it. Last time I did the research there was a 6% difference between the percentage of list price my clients receive for their house when they sell through me and the percentage of list price they pay when they buy through me. In other words they got top dollar for the house they sold and got a great value on the one they bought. It’s a formula for success; for us both.

↓

Want to know just what your house is worth?

Click here for a free market analysis

↓

New Home Construction Update

The fervent building of new homes is having an impact. A lot of the new construction is in the $400 and up range and if you look at the stats of available resale homes that is the price range at which the inventory is higher due to buyers having the choice of new or resale. However every builder I have spoken with in the last 30 days is offering some type of incentive and or discount as they have slowed down just like the resale market. So if you are considering a new home let’s get together and go check them out. Remember it does not cost you anything to have me represent you in the purchase of a new home. Also if you are the type that just likes to cruise new homes casually before moving forward with me just let the salesperson know you have a Realtor at your first visit and if they need a card or call from me I will be glad to do that immediately.

Want to go look at some new homes this weekend?

Click here and let me know when and where you want to go and I will get it all set up!

I’d be happy to go with you too!

↓

Click Here To Search for homes in any area.

If its listed, its here.

Search by map or by detailed criteria free.

Save your favorites, even get automatic emails of homes as they come on the market.

↓

Would you like to view the statistics for your specific area?

Click here to go directly to September’s town by town report.

* data is from Metrolist®. Metrolist® is a registered trademark of Metrolist, Inc. © 2013 Metrolist, Inc.

All rights reserved.